Bidding Overview

CAISO Only & Generally Leap ManagedSubmitting bids is only applicable for the CAISO wholesale marketplace. Most partners leverage Leap to manage bids on their behalf based on their dispatch preferences (frequency & timing). However, this guide and bid endpoints are available for partners that would like to manage their own bids for additional control and flexibility.

Overview

Bids represent offers to supply energy to the market. Use the Bidding API to configure dispatch frequency, duration, and earnings to match your preferences.

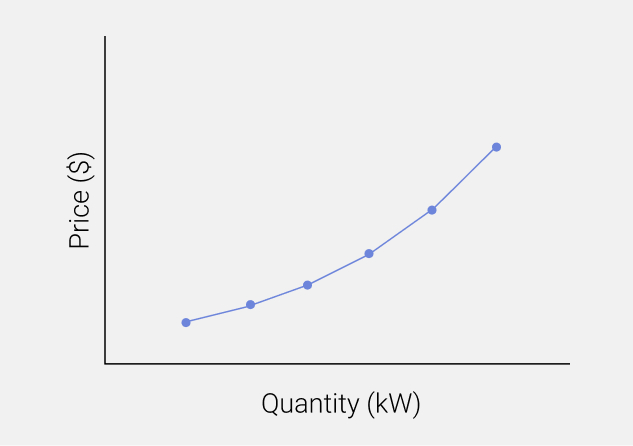

A bid defines the amount of power (in kilowatts) that a meter is willing to provide for a given price (in $/kWh). Bids are structured as a supply curve covering a specific time period. You can offer increasing quantities in exchange for higher prices.

Understanding Bid Curves

A bid curve is an ascending array of price ($) x quantity (kW) pairs. Each point represents an offer to provide energy over a time period in exchange for a given price. The curve allows you to offer higher a quantity_in_kw in exchange for a higher price.

Bidding at the Price FloorIn most cases, partners simply want to bid at the price floor for a certain time period in order to try and get dispatch events awarded during that time. In these cases, a multi-point bid curve is not necessary. You can simply have a single kW/price pair within the

curvearray and the price can be set to the minimum0.01value.

Bid API Endpoints

- Place, modify, or cancel bids for one or more meters for a given time period

- Modify - Bids can be modified by placing a new bid for the same meter/timeslot combination. The previous curve will be completely replaced by the new curve.

- Cancel - Submit an empty

curve[]array or for the same meter/timeslot combination.

- Bids must be in 1-hour increments and all times are in UTC timezone

- The submitted price must be between $ 0.01/kWh and $ 1.00/kWh

- A maximum of 100 meters can be submitted with each Place Bid API call

- All meters must have an

Activeenrollment status for bids to be accepted

- Search for bids that match the input filters

- Search for standing bids that match the input filters

- Standing bids are submitted by Leap based on a combination of 1) market requirements during the 4-10pm PT time period and 2) partner bid preferences (desired frequency and timing of dispatch events)

Day-Ahead & Hour-Ahead Markets

You can submit bids in day-ahead and/or hour-ahead markets. Below is a summary of each.

Day-Ahead

- Use

"market_type": "day-ahead" - Trading day: midnight-to-midnight Pacific Time (PT)

- Submission deadline: midnight Pacific Time (PT) one day prior

- Example timing:

- Tuesday - Bids due by midnight PT for Thursday trading day

- Wednesday - 24-hour downtime for: Leap aggregation, bidding into CAISO, CAISO market awards received, dispatch signal sent out to partners early afternoon PT

- Thursday - Trading/event day (midnight-to-midnight PT)

Hour-Ahead

- Use

"market_type": "hour-ahead" - Trading hour: each 1-hour block is its own trading time period

- Submission window: 3pm PT day prior up to 90 minutes before trading hour

- Example timing:

- Tuesday 4pm PT - Submit bid for 6-7pm PT

- Tuesday 4:30-5:15pm PT - Downtime for Leap aggregation, bidding into CAISO, CAISO market awards received, dispatch signal sent out to partners with ~45 minutes advance notice

- Tuesday 6-7pm PT - Trading/event hour

Example Recipe Using Place Bid Endpoint

Updated 3 months ago